Research

Working Papers:

- Revise and Resubmit, Journal of Finance

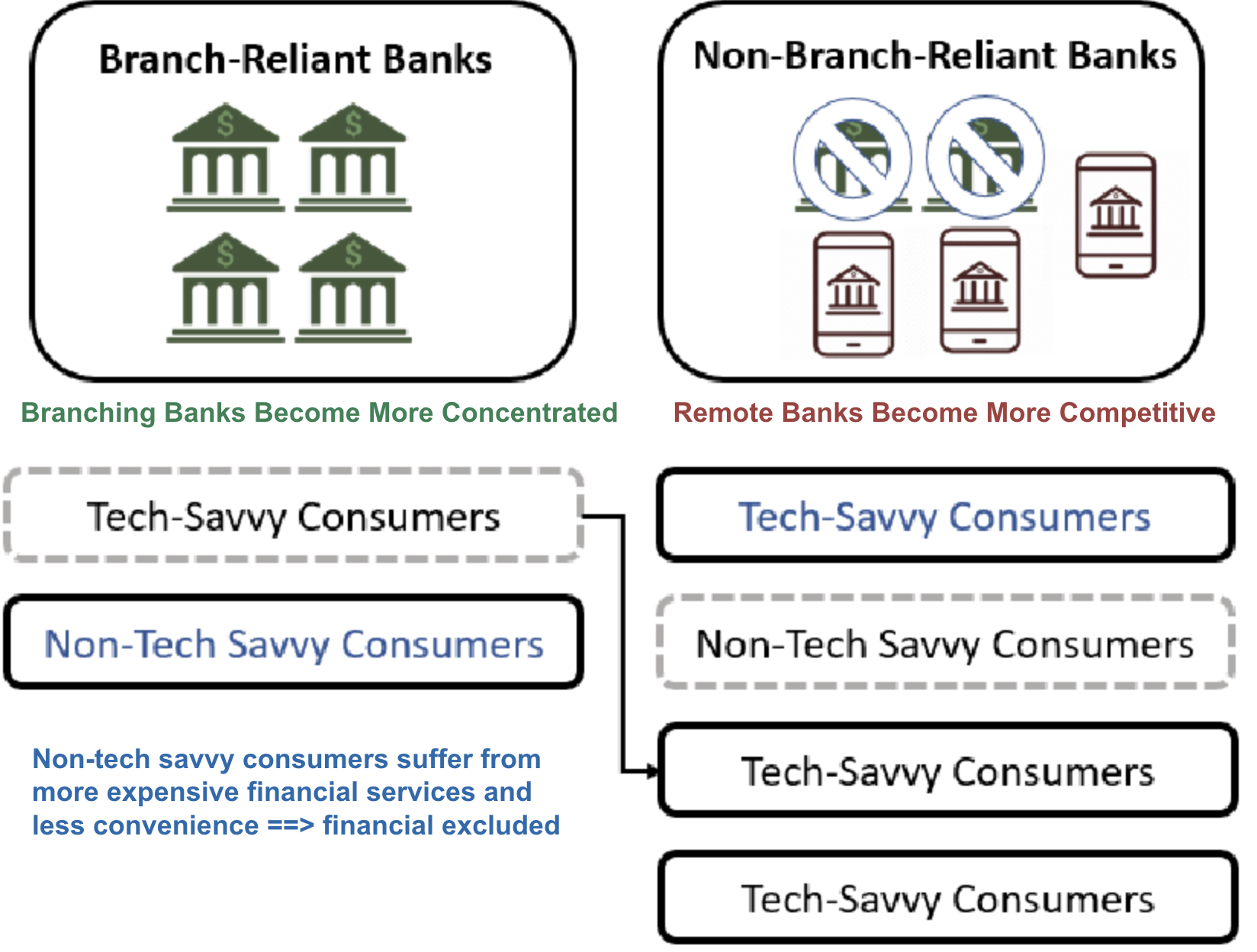

- Summary: Banks' endogenous response to digital disruption can widen inequality in financial inclusion (Empirics with structural estimation)

Abstract: (click)

We study how digital disruption impacts bank competition, considering consumers’ heterogeneous digital preferences. Exploiting the rollout of 3G mobile networks, we find that digital disruption geographically expands bank lending but contracts bank branch networks. Meanwhile, more (less) branch-reliant banks increase (decrease) prices. These developments result in a distributional effect, reducing the unbanked rate among young consumers while increasing it among the elderly. A structural model shows that increased digital preference of young borrowers drives banks’ branch adjustment, causing significant surplus losses for older savers. Regulating branch closures could mitigate the distributional impact as the banking sector undergoes digital transformation.

- Revise and Resubmit, Journal of Financial Economics

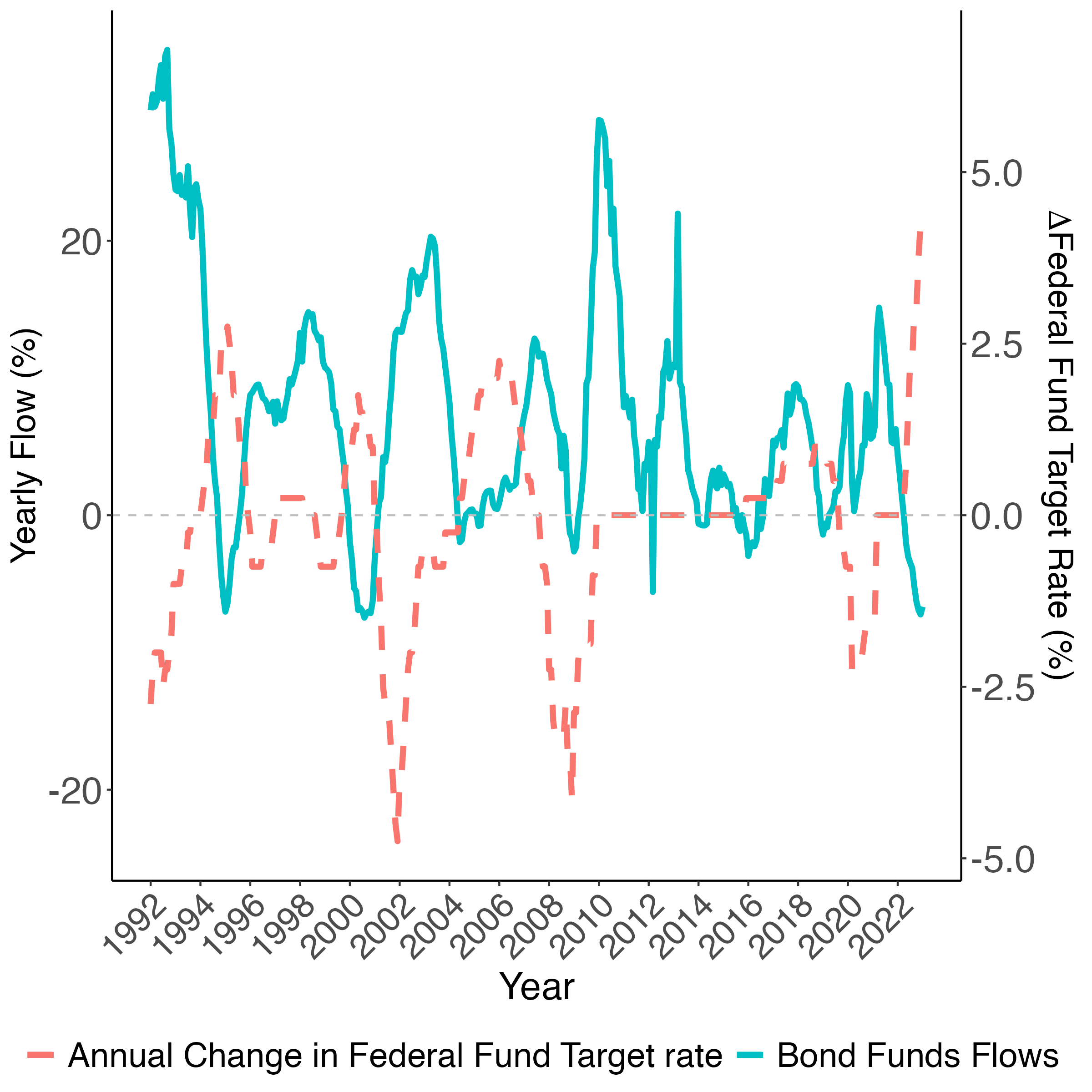

- Summary: Document and explain the dynamics of outflows from corporate mutual funds triggered by increases in Federal Reserve interest rates (Theory & Empirics)

Abstract: (click)

We document aggregate outflows from corporate bond funds days before and after the announcement of increases in the Federal Funds Target rate (FFTar). To rationalize this phenomenon, we build a model in which funds’ net-asset-values (NAVs) are stale and investors strategically redeem to profit from the mispricing when they learn about the increases of FFTar. Consistent with the model's predictions, we find that stale NAVs and loose monetary policy environments weaken (strengthen) outflows sensitivity to increases in FFTar during illiquid (liquid) market conditions. Our results highlight when and how monetary policy could systematically exacerbate the fragility of corporate bond funds.

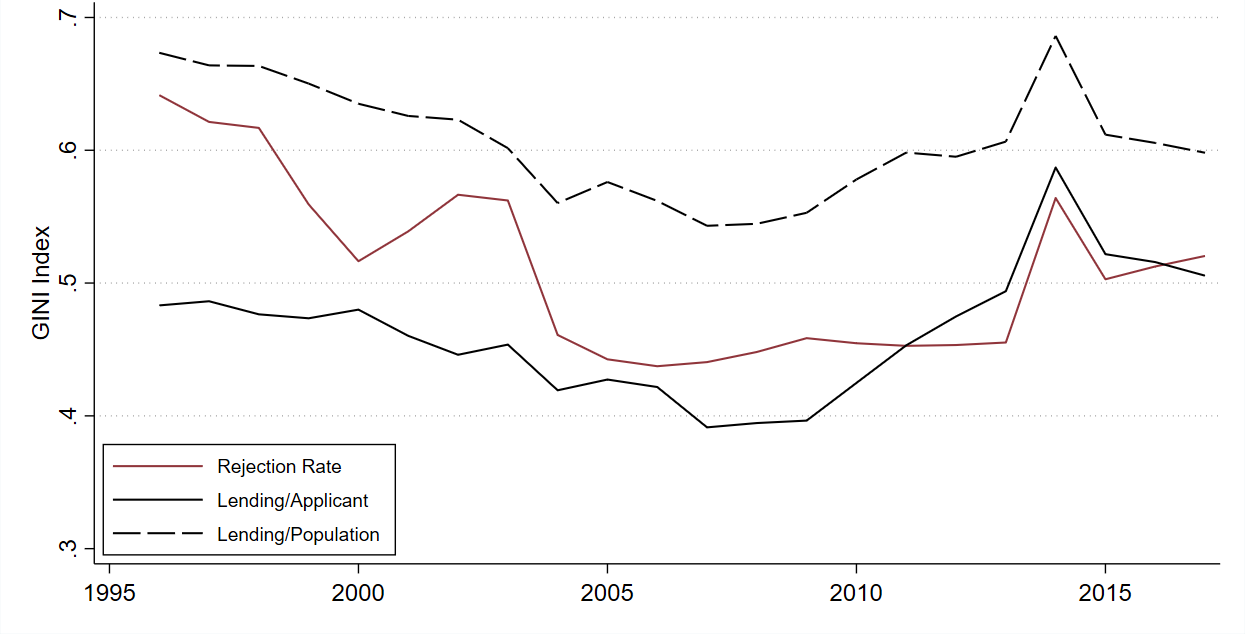

- Summary: A policy intended to mitigate credit access inequality may inadvertently lead to a reduction in bank branches, exacerbating disparities in credit access across different regions (Empirics)

- Scheduled: NBER Corporate Finance; HEC-Mcgill Winter Finance Conference

Abstract: (click)

We uncover that the Community Reinvestment Act (CRA), a major policy aimed to reduce geographic inequality in credit access, can widen disparities across regions, despite enhancing credit equality within certain regions. This adverse effect arises because banks withdraw branches from economically disadvantaged areas to sidestep the rules. As financial activities shift towards shadow banks, the adverse impact of the CRA is amplified, expanding the set of disadvantaged areas suffering from branch withdrawals. Using a regression discontinuity design centered on a CRA eligibility threshold, we estimate banks' shadow costs of violating the CRA. We then show that banks with higher costs of CRA violation retract their branches from disadvantaged areas following the expansion of shadow banks. This retraction results in declines in small business lending, business establishments, and employment, predominantly in low-income neighborhoods within these disadvantaged regions. Such dynamics could contribute to the worsening cross-region disparities in credit access observed over the recent decade.

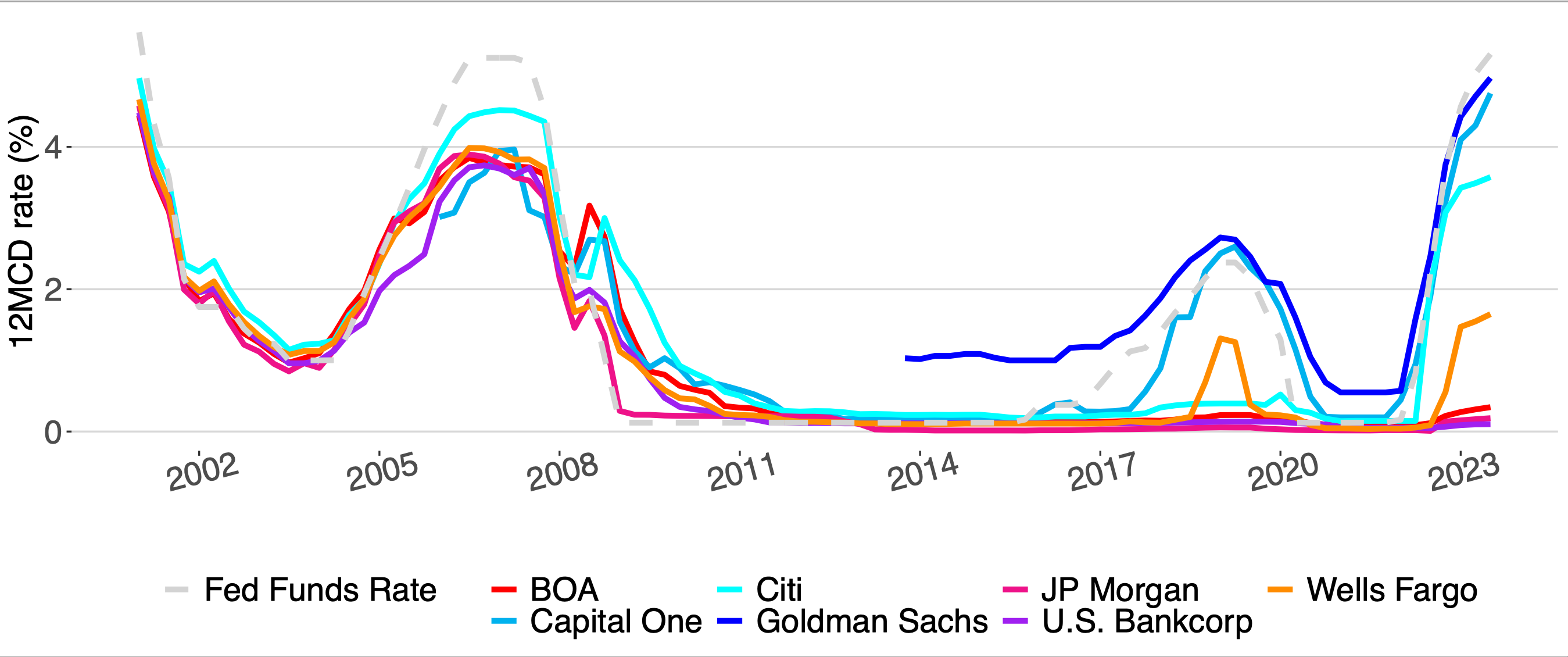

- Summary: The banking sector is diverging: 1) some banks maintain branches, offer low deposit rates, and opt for safe but long-term securities; 2) others switch to e-banking only, offer high deposit rates, and tilt towards short-term but risky loans. This divergence significantly impacts monetary policy transmission and the banking industry's overall risk-maturity profile (Empirics)

- Scheduled: SFS Cavalcade, WFA, AFBER, CEPR Conference on Financial Stability and Regulation, University of Kentucky Finance Conference, Junior Finance Conference at HBS

Abstract: (click)

We document the emergence of two distinct types of banks over the past decade: highrate banks, which align deposit rates with market interest rates, hold shorter-term assets, and primarily earn lending spreads by taking more credit risks through personal and business loans; and low-rate banks, which offer interest-insensitive, low deposit rates, hold a larger proportion of long-term securities (e.g., MBS), and make fewer loans. This divergence in the banking sector leads to a significant shift of deposits towards high-rate banks as interest rates rise, thereby reducing the sector's overall capacity for maturity transformation and increasing its exposure to credit risk, particularly through personal loans. Our evidence suggest that technological advancements in banking spurred the divergence: high rate banks operate primarily online and attract less sticky depositors. In response, low rate banks lower rates through the retention of relatively stickier depositors.

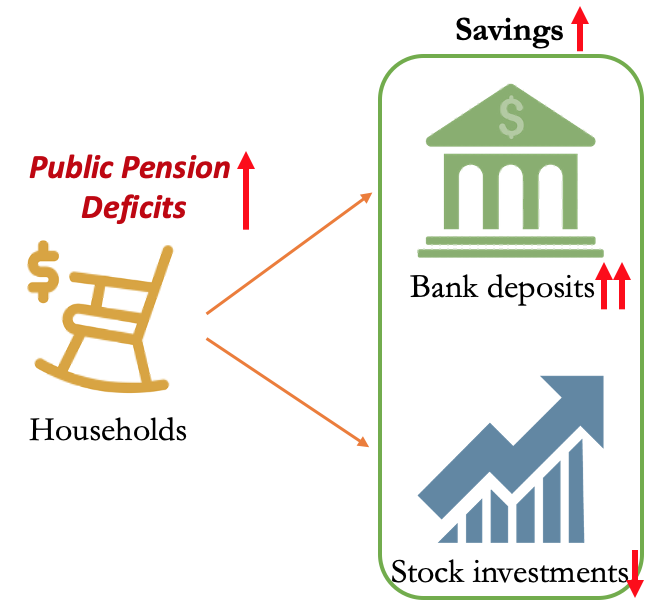

- Summary: Households respond to very large state public pension deficits by saving more, and by shifting towards safe bank deposits and away from risky stocks (Empirics)

Abstract: (click)

US public state pension deficits are very large, accounting for 18.5% of an average state's GDP and up to 50% in Illinois. In principle, households should respond to this heavy future burden by increasing current savings, particularly in safe assets, since pension deficits are countercyclical. Comparing households residing on opposing sides of a state's border, I document that households in larger-deficit states save more, investing more in safe bank deposits and less in risky stocks. Specifically, households hold 0.70 dollars more in deposits and 0.33 dollars less in stocks for each additional dollar of pension deficit. This effect strengthened further following the implementation of new accounting standards in 2015 that made deficits more salient by requiring states to publicly disclose them. Exploiting staggered state pension reforms, I also find that households respond consistently when states reduce pension deficits; they decrease deposits and increase stock holdings. These reallocations spill over onto local economic activity: as households withdraw deposits following a pension reform, exposed local banks cut lending to local businesses.

- Summary: When passive investors fulfill their fiduciary duty to do governance, they can unintentionally create market inefficiencies (Theory)

Abstract: (click)

While regulators stress the importance of passive investors' fiduciary duty in corporate governance, we argue that when passive funds fulfill their fiduciary duty to increase a firm’s value, they unintentionally create market inefficiencies. In our model, investors acquire information, optimize portfolios, and affect a firm's value through governance. In equilibrium, bad firms are left governed by passive investors, a consequence of market clearing. Therefore, when passive investors increase a firm's value, they increase it more for bad firms, reducing information sensitivity and generating market inefficiencies. We offer unique empirical predictions and explore applications on ESG policies and product market competition.

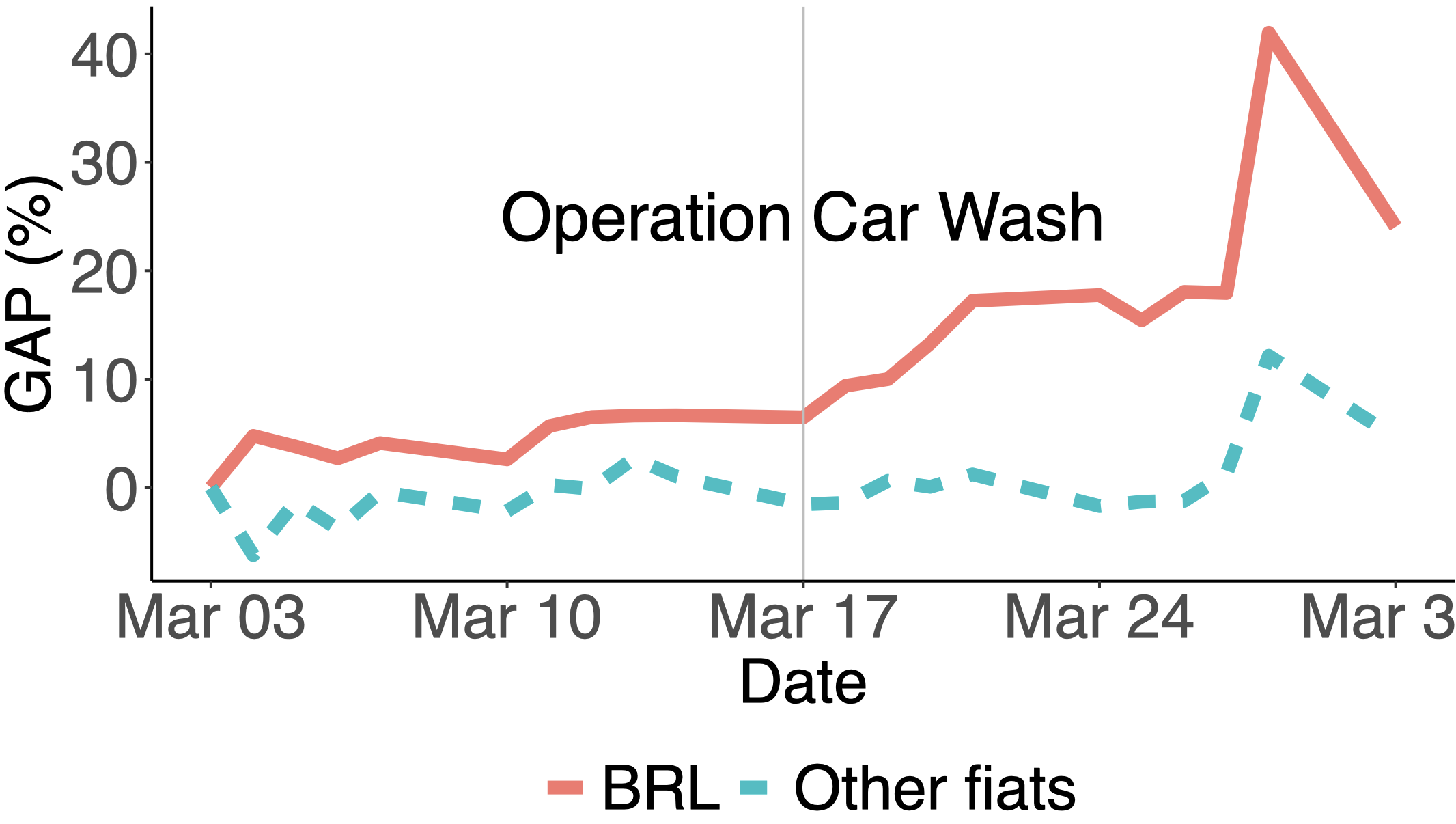

- Summary: Local demand for Bitcoin surges under high economic policy uncertainty, mainly due to distrust of government (Empirics)

- Award: Runner-up in the 2019 Toronto FinTech Conference

Abstract: (click)

This paper uncovers a novel phenomenon of flight-to-Bitcoin (FTB) whereby local demand for Bitcoin increases with local economic policy uncertainties. FTB holds across Bitcoin demand proxies including local premiums over the US market, turnover, and web traffic on cryptocurrency exchanges. We find that FTB is mainly driven by a lack of confidence in local authorities. Consistent with this interpretation, FTB is stronger during corruption incidents and Bitcoin ownership shifts from centralized exchanges to decentralized wallets amid turbulence. A comparison with safe-haven assets further differentiates FTB from other forms of flight-to-safety. The evidence collectively illustrates one overlooked motivation of Bitcoin investment: investors hold Bitcoin to mitigate their concerns about local authorities.

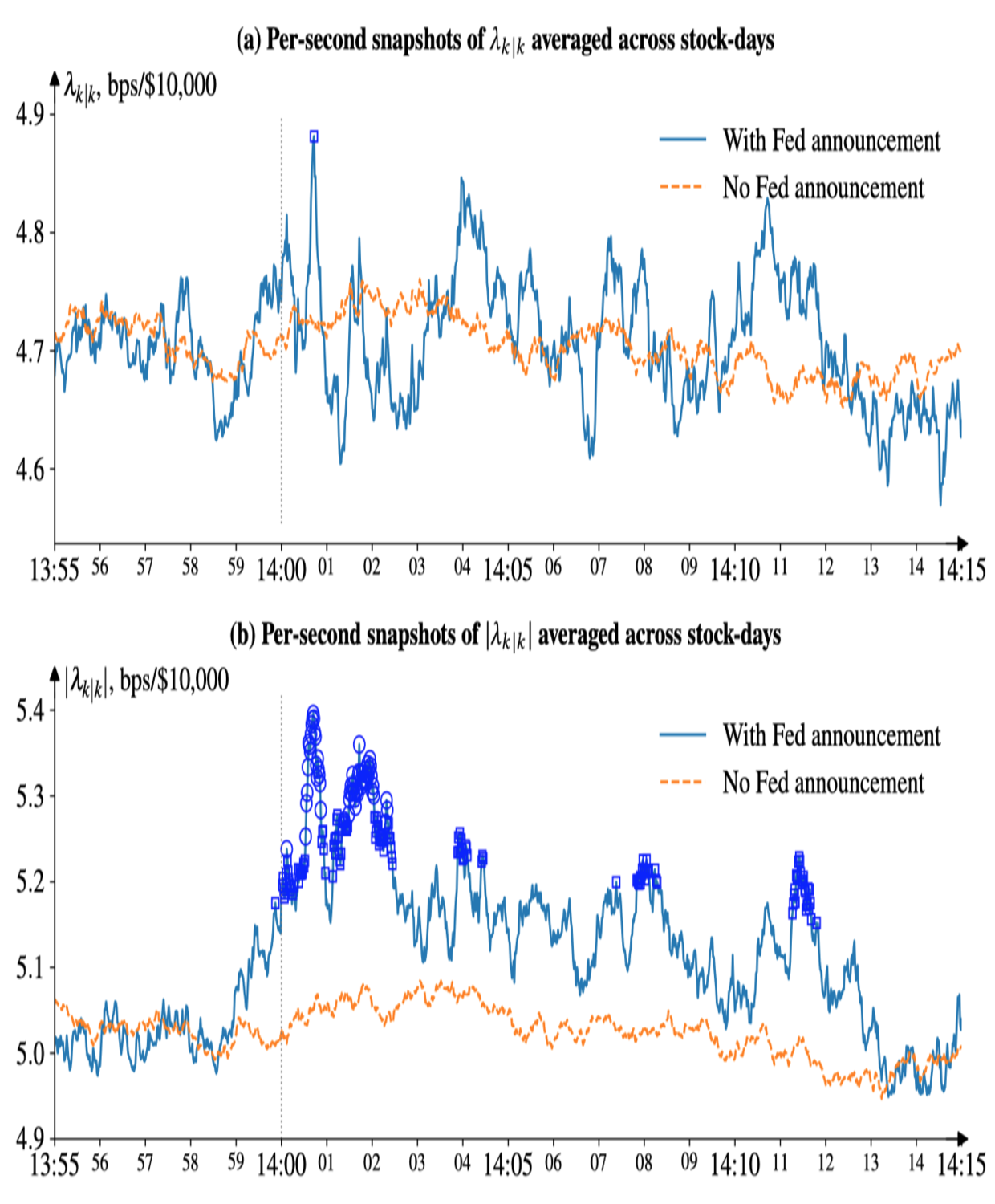

- Summary: Kyle's lambda can be negative when informed investors trade via limit orders. We develop a structural model to quantify dynamics of high-frequency trades' price impact (Empirics)

- Award: Best Paper by a Young Researcher Award ($1500) in 2018 CEPR-Imperial-Plato Market Innovator (MI3) Conference

Abstract: (click)

This paper develops a structural model to examine high-frequency price dynamics. The key innovation is to allow trades' permanent price impact to be time-varying—dynamic trade informativeness. A distribution-free filtering technique pins the real-world data to the model. The filtered series (i) significantly recover the efficient price innovation through the dynamics of trade informativeness, (ii) improve trades' explanatory power for future returns, (iii) distinguish informativeness from trades' aggressiveness, (iv) gauge informed investors' patience, and (v) capture systematic patterns around scheduled and unscheduled events, as well as general intraday trends. The framework contributes to the better utilization of high-frequency trading data.

Publications:

Conditional Extremes in Asymmetric Financial Market, with Natalia NoldeJournal of Business & Economic Statistics, 38, 2020

Abstract: (click)

The global financial crisis of 2007–2009 revealed the great extent to which systemic risk can jeopardize the stability of the entire financial system. An effective methodology to quantify systemic risk is at the heart of the process of identifying the so-called systemically important financial institutions for regulatory purposes as well as to investigate key drivers of systemic contagion. The article proposes a method for dynamic forecasting of CoVaR, a popular measure of systemic risk. As a first step, we develop a semi-parametric framework using asymptotic results in the spirit of extreme value theory (EVT) to model the conditional probability distribution of a bivariate random vector given that one of the components takes on a large value, taking into account important features of financial data such as asymmetry and heavy tails. In the second step, we embed the proposed EVT method into a dynamic framework via a bivariate GARCH process. An empirical analysis is conducted to demonstrate and compare the performance of the proposed methodology relative to a very flexible fully parametric alternative.

Dependence Modeling, 1, 2013

Abstract: (click)

Nelsen et al. (2004) find bounds for bivariate distribution functions when there are constraints on the values of its quartiles. Tankov (2011) generalizes this work by giving explicit expressions for the best upper and lower bounds for a bivariate copula when its values on a compact subset of [0; 1]2 are known. He shows that they are quasi-copulas and not necessarily copulas. Tankov (2011) and Bernard et al. (2012) both give sufficient conditions for these bounds to be copulas. In this note we give weaker sufficient conditions to ensure that both bounds are simultaneously copulas. Furthermore, we develop a novel application to quantitative risk management by computing bounds on a bivariate risk measure. This can be useful in optimal portfolio selection, in reinsurance, in pricing bivariate derivatives or in determining capital requirements when only partial information on dependence is available.